Debunking Homebuying Myths: You May Need Less Than You Think for a Down Payment

Debunking Homebuying Myths: You May Need Less Than You Think for a Down Payment

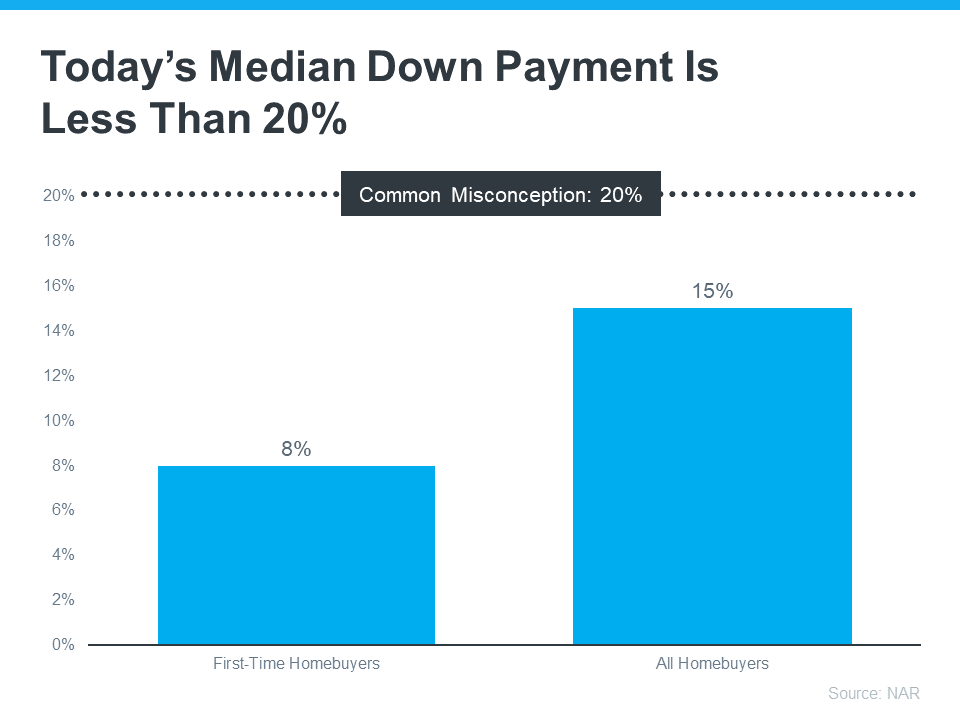

The road to homeownership often seems dominated by one looming figure: the 20% down payment. This number can appear as a formidable gatekeeper, holding many prospective buyers back from pursuing their homeowning aspirations. But the reality is far more welcoming than this outdated standard suggests.

The Down Payment Misconception

It's a common misconception that a 20% down payment is a non-negotiable requirement for buying a home. This belief, while grounded in traditional practices, doesn't hold up against the current trends and options available to homebuyers.

Reports from The Mortgage Reports clarify that "Although putting down 20% to avoid mortgage insurance is wise if affordable, it's a myth that this is always necessary. In fact, most people opt for a much lower down payment." The actual data echoes this sentiment, showing that the median down payment for all homebuyers is currently at 15%, and an even more attainable 8% for those buying their first home.

Rethinking the Median Down Payment

A closer look at the numbers reveals that the expected down payment for most homebuyers is well below the 20% mark, a fact that could change the game for many who are on the fence about diving into homeownership.

Accessing Homebuyer Assistance

There's more good news: over 2,000 homebuyer assistance programs across the United States are designed to help with down payments. With offerings like FHA loans that require as little as 3.5% down, to VA and USDA loans and first time homebuyer programs that may eliminate the down payment entirely for qualified individuals, the pathway to owning a home is broadening.

Making Smart Moves in Homebuying

The critical takeaway from this is that saving for a home may be more achievable than you've been led to believe. It's crucial to seek out the best resources and knowledgeable professionals who can guide you to programs and lending options that can make homeownership a reality sooner than you might expect.

Concluding Thoughts

The myth of the mandatory 20% down payment is just that—a myth. With a market ripe for buyers and various supportive programs and loans, the possibility of owning a home is more accessible than ever. As prices are projected to increase, securing a home now, even with a smaller down payment, might just be the smart financial move.

If you're contemplating a home purchase, don't hesitate to reach out. Together, we can navigate the current landscape to find a fitting solution for your homebuying needs.

If you'd like a copy of our FREE Comprehensive Homebuyer's Guide to help you plan properly, you can find it here:

Homebuyer's Guide

Categories

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "